how much does nc tax your paycheck

After a few seconds you will be provided with a full breakdown of the tax you are paying. As you can see North Carolina did not increase tax rate for 2021.

Pin On Information For The Area

PO Box 25000 Raleigh NC 27640-0640.

. Defined in Section 96-92 c as the totals for all insured employers. The North Carolina bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. However withdrawals from retirement accounts are fully taxed.

North Carolina Income Tax Calculator 2021. North Carolina Department of Revenue. 95-258 a 2 - The amount of a proposed deduction.

North Carolina Estate Tax. Subtract and match 62 of each employees taxable wages until they have earned 147000 2022 tax year for that calendar year. 95-258 Withholding of Wages an employer may withhold or divert any portion of an employees wages when.

Greater than 1 but less than or equal to 125. A 2020 or later W4 is required for all new employees. New Federal Tax Withholding Tables were added to the Integrated HR-Payroll System last month and many of you are wondering if you need to change your withholding allowance.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. North Carolinas statewide gas tax is 3610 cents per gallon for both regular and diesel. Hourly non-exempt employees must be paid time and a half for hours worked beyond 40 hours in a workweek.

Learn North Carolina income tax property tax rates and sales tax to estimate how much youll pay on your 2021 tax return. Skip to main content. North Carolina Tax Brackets for Tax Year 2021.

Individual income tax refund inquiries. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. Every taxpayer in North Carolina will pay 525 of their taxable income for state taxes.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Subtract and match 145 of each employees taxable wages until they have earned 200000. This results in roughly 3764 of your earnings being taxed in total.

Calculate your North Carolina net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free North Carolina paycheck calculator. Income taxes FICA and court ordered garnishments NCGS. Filing 2500000 of earnings will result in 61127 of your earnings being taxed as state tax calculation based on 2022 North Carolina State Tax Tables.

Minimum Wage in North Carolina in 2021. Social Security income in North Carolina is not taxed. North Carolinas flat tax rate for 2018 is 549 percent and standard deductions were 8750 if you filed as single and 17500 if you were married and filing.

For example for 2021 if youre single and making between 40126 and 85525 then you are responsible for paying 22 percent of your. 95-258 a 1 - The employer is required to do so by state or federal law. Taxpayers may pay their tax by using a creditdebit card VisaMasterCard or bank draft via our online payment system or by contacting an agent.

The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks. In North Carolina both long- and short-term capital gains are treated as regular income which means the 525 flat income tax rate applies. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

The calculated Contribution Rate for any given tax year applies equally to all experience rated employers. Here you can find how your North Carolina based income is taxed at a flat rate. North Carolina Gas Tax.

North Carolina Department of Revenue. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on. Additionally pension incomes are fully taxed.

Use Before 2020 if you are not sure. Filing 2500000 of earnings will result in 191250 being taxed for FICA purposes. If you make 70000 a year living in the region of North Carolina USA you will be taxed 11498.

Individual Income Tax Sales and Use Tax Withholding Tax Corporate Income Franchise Tax Motor Carrier Tax IFTAIN Privilege License Tax Motor Fuels Tax. - North Carolina State Tax. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020.

PO Box 25000 Raleigh NC 27640-0640. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes. When it does come to the tax side of things if youre considering a move to North Carolina for retirement its important to keep the following in mind.

The IRS recently added a new Withholding Calculator to their website and encourages all employees to use the calculator to perform a quick paycheck checkup. North Carolina has not always had a flat income tax rate though. These taxes are typically withheld from severance payments.

Issuing comp time in place of overtime pay is not allowed for non-exempt employees. North Carolina has a flat income tax of 525. How Much Does Nc Tax Your Paycheck.

The North Carolina Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and North Carolina State Income Tax Rates and Thresholds in 2022. Any wages above 147000 are exempt from the Social Security Tax. Switch to North Carolina hourly calculator.

North Carolina Salary Paycheck Calculator. Take Your 2019 Standard Deduction. To use our North Carolina Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

North Carolina Paycheck Calculator. North Carolina repealed its estate tax in 2013. Payroll check calculator is updated for payroll year 2022 and new W4.

North Carolina income is taxed at a constant rate of 525. Individual income tax refund inquiries. Details of the personal income tax rates used in the 2022 North Carolina State Calculator are published.

2 000 After Tax Us Breakdown May 2022 Incomeaftertax Com

Home Ownership Is A Big Responsibility And Takes Some Preparation Here Is A Few Small Steps You C Credit Repair Credit Repair Services Credit Repair Companies

Paperwork Needed For Buying A House Home Buying Home Buying Process Buying First Home

The Tampon Tax Explained Tampon Tax Pink Tax Tampons

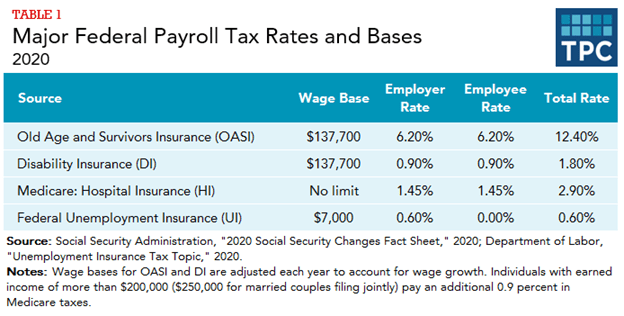

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

5 Bank Accounts Your Family Needs Bank Account Accounting Budgeting Money

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Pin On Bandz Bread Green Backs

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Pin On Bookkeeping And Accounting

Everyone Needs A Homebased Business Business Business Builders Home Based Business

Best Representation Descriptions Does Walmart Cash Cashiers Checks Related Searches Auto Insurance Claim C Credit Card Design Money Template Payroll Template

The Pension Protection Act Of 2006 And How It Still Helps Retirement Investing For Retirement Pensions Investment Advice

Free North Carolina Payroll Calculator 2022 Nc Tax Rates Onpay

Understanding Your Paycheck Http Www Hfcsd Org Webpages Tnassivera News Cfm Subpage 1077 Student Teaching Teaching Activities Understanding Yourself

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

How To Understand Your Paycheck Youtube Personal Financial Literacy Financial Literacy Understanding Yourself

How To Provide Value To Your Clients Marketing Flyers Saving Habits Sales And Marketing